March 2025 was a optimistic month for the insurance-linked securities (ILS) fund sector, with a powerful 0.82% common return throughout the sector in accordance with the ILS Advisers Fund Index.

At a 0.82% common return throughout the ILS funds tracked within the Index, March 2025 was the fourth highest efficiency for that month since monitoring started.

For the first-quarter of 2025, the results of the California wildfires have remained the primary detractor from efficiency for the 12 months thus far, with the ILS Advisers Fund Index at -0.85% for the 12 months to March thirty first.

Combination disaster bond and ILS positions felt the results of US extreme climate within the month, with additional impacts as some positions collected extra losses.

ILS Advisers defined, “A robust early-season extreme climate system swept throughout the central and southern U.S. in March, producing quite a few tornadoes, hail, and wildfires. These occasions will additional erode multi-peril mixture ILS positions.”

Which was evident in the reporting from catastrophe bond sponsor Allstate, which stated through the month it now anticipates a recuperate from its mixture Sanders Re cat bonds after the extreme climate occasions in March.

Regardless of this extra affect from mixture disaster losses, in addition to any impacts to any personal ILS positions from the identical in March, the business reported a powerful efficiency contemplating.

All 29 of the ILS funds tracked by the ILS Advisers Index which have reported returns for the month thus far had been optimistic for March 2025.

Non-public ILS fund methods, that allocate throughout the spectrum of ILS devices, reinsurance and retrocession, delivered a 0.94% return as a bunch.

Disaster bond funds had been barely decrease, because the pure cat bond funds tracked by the Index delivered a 0.75% acquire for March.

There was a comparatively vast efficiency vary, as we frequently see, with the worst performing fund returning 0.43%, whereas the perfect performing ILS fund tracked by the Index in March delivered a 1.50% return.

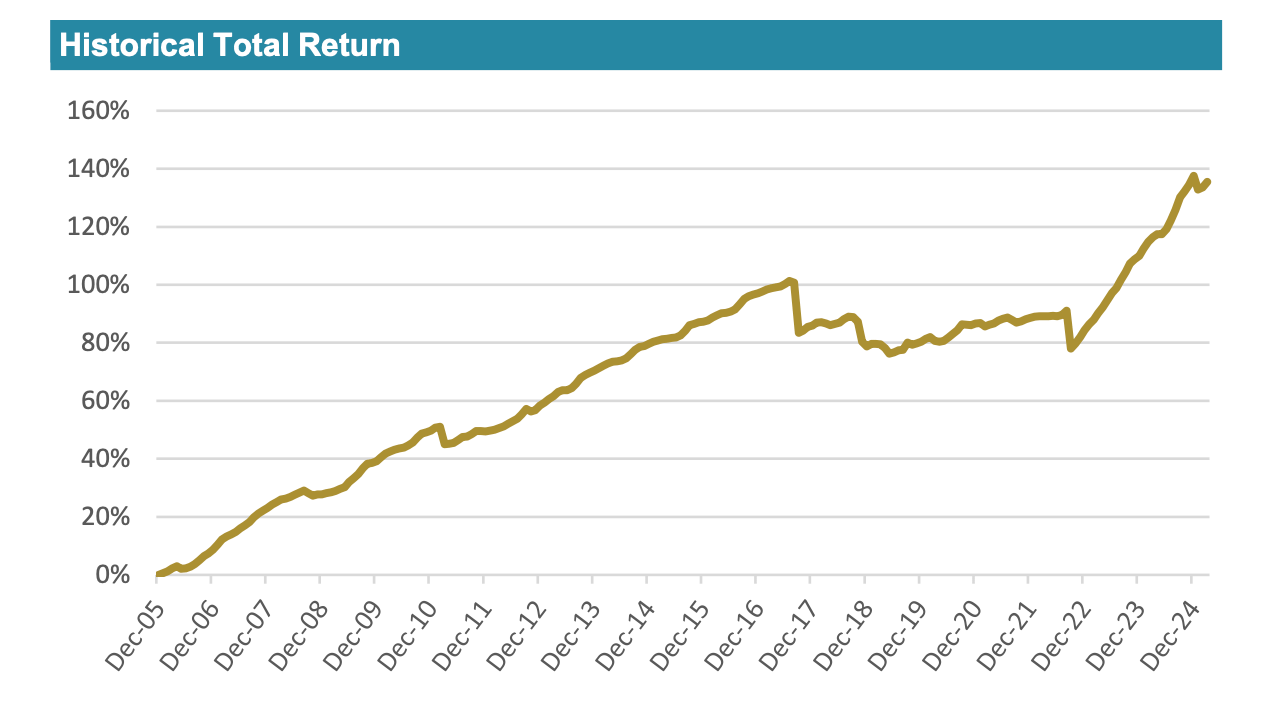

You’ll be able to observe the ILS Advisers Fund Index here on Artemis. It contains an equally weighted index of 37 constituent insurance-linked funding funds which tracks their efficiency and is the primary benchmark that enables a comparability between completely different insurance-linked securities fund managers within the ILS, reinsurance-linked and disaster bond funding house.