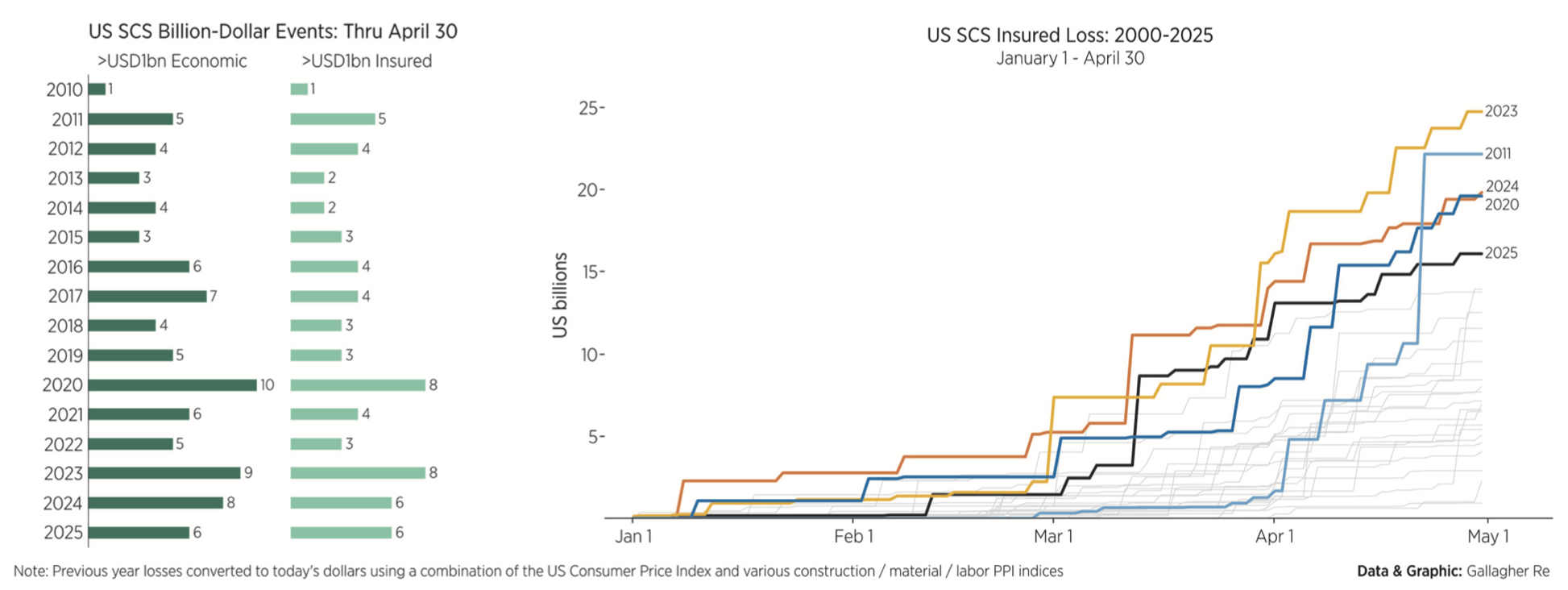

Extreme convective storm (SCS) exercise throughout the US has now price the insurance coverage and reinsurance trade greater than $20 billion in 2025, dealer Gallagher Re estimates, with its Chief Science Officer Steve Bowen highlighting that the Could 14th to twentieth outbreak might drive insured losses of as much as $7 billion.

2025 turns into the eighth 12 months out of the final 9 the place extreme convective storm (SCS) insured losses within the US have topped $20 billion, with the current outbreak having accelerated the aggregation of losses from this peril significantly.

Steve Bowen, Chief Science Officer and Meteorologist at reinsurance dealer Gallagher Re defined, “We now report that there have been eight particular person billion-dollar US SCS insured loss occasions so far in 2025 via Could 20. This compares to current 12 months totals via the top of Could in 2024 (13), 2023 (11), 2022 (6), 2021 (6), and 2020 (12).

“The current stretch of US thunderstorm exercise has sadly left a substantial path of destruction throughout many states and communities.

“As we speak we launch our newest occasion commentary that features our preliminary insured loss estimate of $4 billion to $7 billion for the complete Could 14-20 timeframe. That is topic to alter. Uninsured harm is predicted to drive the general direct financial price greater by a minimum of one other billion.”

Tornadoes have pushed a significant proportion of damages to date this 12 months, Bowen mentioned, with “35 tornadoes rated both EF3 (30) or EF4 (5).”

“For the reason that Enhanced Fujita (EF) Scale went operational in 2007, the 35 EF3+ tornadoes so far in 2025 sits behind solely 2011 (74) and 2008 (50) for totals via Could,” he additional defined.

Giant and damaging hail from these extreme thunderstorms has been an additional driver of insured losses, with 2025 now some of the prevalent years on document for that peril as properly.

Bowen mentioned that, “From a big hail (2.0+ inches) perspective, the US has recorded 415 such native storm stories via Could 20. When in comparison with earlier years over the identical interval, 2025 ranks solely behind 2024 (493), 2023 (465), and 2005 (425) courting to a minimum of 1950.”

Consequently, “The US heads towards the beginning of the Atlantic hurricane season with insurance coverage trade losses already past $60 billion for the 12 months,” Bowen additional said.

Saying, “We’ve lengthy handed the purpose of justifying any semantic categorization that considers SCS to be a “secondary” peril for the US insurance coverage market. This has confirmed itself to be perennial main loss driver for a lot of insurance coverage carriers.

“Reinsurers, nevertheless, stay very properly capitalized and in place to soak up sizeable pure disaster losses ought to they come up within the months to come back.”

The year-to-date 5-year common for US extreme thunderstorm insured losses stands at $25 billion, whereas the YTD 10-year common is $19 billion, so the latter has already been exceeded in 2025.

With major insurance coverage carriers estimated to face between $4 billion and $7 billion of losses from the Could 14th to twentieth outbreak of extreme climate, tornadoes, hail, damaging winds and flooding rains, it suggests additional erosion of combination reinsurance deductibles and a few further aggregation to reinsurance preparations which have already connected.

This might embrace some additional erosion for a lot of combination disaster bonds which have confronted erosion of their combination retention or connected, with the potential to drive losses greater for a few of these already on the hook for losses within the still-running annual threat interval.

The aggregation of losses via the 12 months so removed from the SCS peril, “Additional exhibits how convective storms are persevering with to drive larger combination losses for the trade. The mixture of rather more inhabitants and housing unit publicity in high-risk areas, plus extra constant impacts from giant hail, straight-line winds, and tornadic exercise, are the first components of why SCS losses proceed to speed up,” Gallagher Re defined in its occasion report.

Additionally learn:

– Severe weather outbreaks in May could rank among costliest in U.S. history, Aon reports.

– Severe weather & tornado outbreak could drive $5bn+ insured losses: BMS’ Siffert.