Allstate reported a comparatively low stage of disaster losses for February, that means qualifying losses beneath its combination Sanders Re disaster bonds stay an inexpensive distance from attachment ponts, we’re informed, so with the annual threat interval nearing its finish these notes at the moment are being seen as safer, in accordance with sources.

US insurer Allstate has solely reported $92 million of pre-tax disaster losses from the month of February 2025.

That got here on the heels of the significant $1.08 billion pre-tax catastrophe loss estimate for January, following the devastating wildfires in California.

After February, meaning Allstate’s complete disaster losses year-to-date in 2025 had reached $1.17 billion, or $922 million after-tax.

With its combination disaster bonds already having seen their attachment deductibles partially eroded all through the annual threat interval, which runs from April 1st, the Los Angeles wildfires had been seen as an occasion that might tip the excellent cat bond tranches that present combination reinsurance to Allstate nearer to attaching.

Because of this, the costs had been marked down considerably in some circumstances, on cat bond dealer pricing sheets.

The wildfires had pushed a big gross loss impression for Allstate, given the disclosure of extra a $1.4 billion reinsurance restoration being anticipated for the occasion, leaving the $1.08 billion internet.

As we stated on the time, the wildfire losses had been “prone to drive a big erosion of the attachment deductible for these cat bonds, successfully making them riskier over the remainder of their annual combination time period to the top of March.”

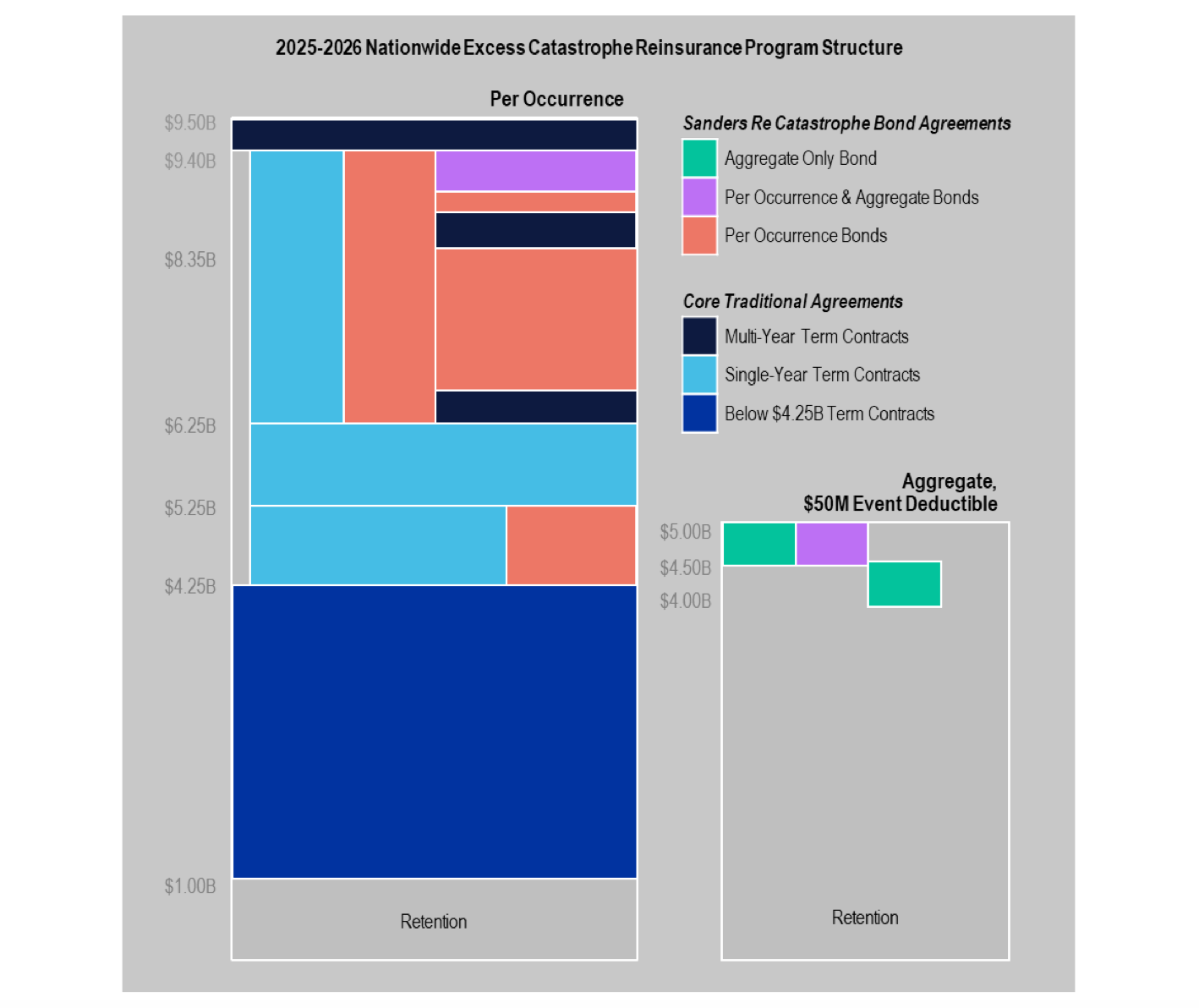

Allstate’s pre-tax disaster losses had reached roughly $5.4 billion since April 1st 2024 by the top of February 2025, so the relevant pre-tax determine that maps to the chance interval for its excellent Sanders Re combination disaster bond notes.

Nonetheless, as we’ve defined prior to now, given the $50 million per-event deductible that must be surpassed for disaster losses to qualify beneath the phrases of the disaster bonds, in addition to the very fact the cat bonds present particular protection for components of Allstate’s e book, it appears (from earlier quarters) that solely someplace between 50% and 70% of the pre-tax disaster loss determine appears to qualify to erode the combination attachment deductibles.

The truth is, we all know that the cat bond relevant combination disaster loss determine had reached $1.7 billion by the top of July 2024, in comparison with the pre-tax loss determine of $2.64 billion at the moment.

With the Allstate combination cat bonds, the riskiest sit at an attachment of $3.6 billion for the present threat interval that runs to the top of March 2025 and at this stage we’re informed the combination relevant loss stays an inexpensive distance from the set off level, though we would not have a selected determine for that at the moment.

Given February’s low stage of disaster losses, we’re informed confidence that the Allstate combination cat bonds will get by means of the remainder of the chance interval with out attaching their protection has risen.

Sources additionally informed us that two of the riskiest combination tranches of Allstate’s Sanders Re disaster bonds have seen their secondary market costs marked-up significantly on one of many ILS market’s pricing sheets.

We’re informed that is possible in response to the insurer reporting a a lot much less impactful month in disaster loss phrases for February, and the truth that the annual threat interval finish date for the notes is nearing.

It’s necessary to notice that there might be extra qualifying disaster losses for the full-month of March 2025 that erode the combination retention deductible for the Sanders Re disaster bond tranches as properly, not least due to the recent severe convective weather outbreak that we reported on last week.

Nonetheless, our sources say they don’t consider this occasion alone might increase the qualifying cat loss determine by wherever close to sufficient for the cat bonds to connect. Which means that there would must be extra impactful disaster losses over the following week that increase Allstate’s combination loss tally meaningfully, if any of its combination cat bonds are to face a loss as a result of present and now almost over threat interval.

Different combination cat bonds which have been marked down, some closely, for the reason that wildfires are likely to have their annual threat interval finish nearer to the mid-year, so these preparations have longer to run by means of the height of the US extreme convective storm season, and taking a look at pricing for them some are actually not thought of protected from doubtlessly attaching but.