Evaluation from reinsurance dealer Howden Re suggests {that a} cyber disaster {industry} loss occasion of $9 billion or extra would end in extra significant losses to the excellent cyber cat bond market, and that cat bond might outperform on a restoration foundation for cedents.

In a brand new latest paper, Howden Re appeared on the robustness of the cyber reinsurance market and the vary of devices accessible to cedents.

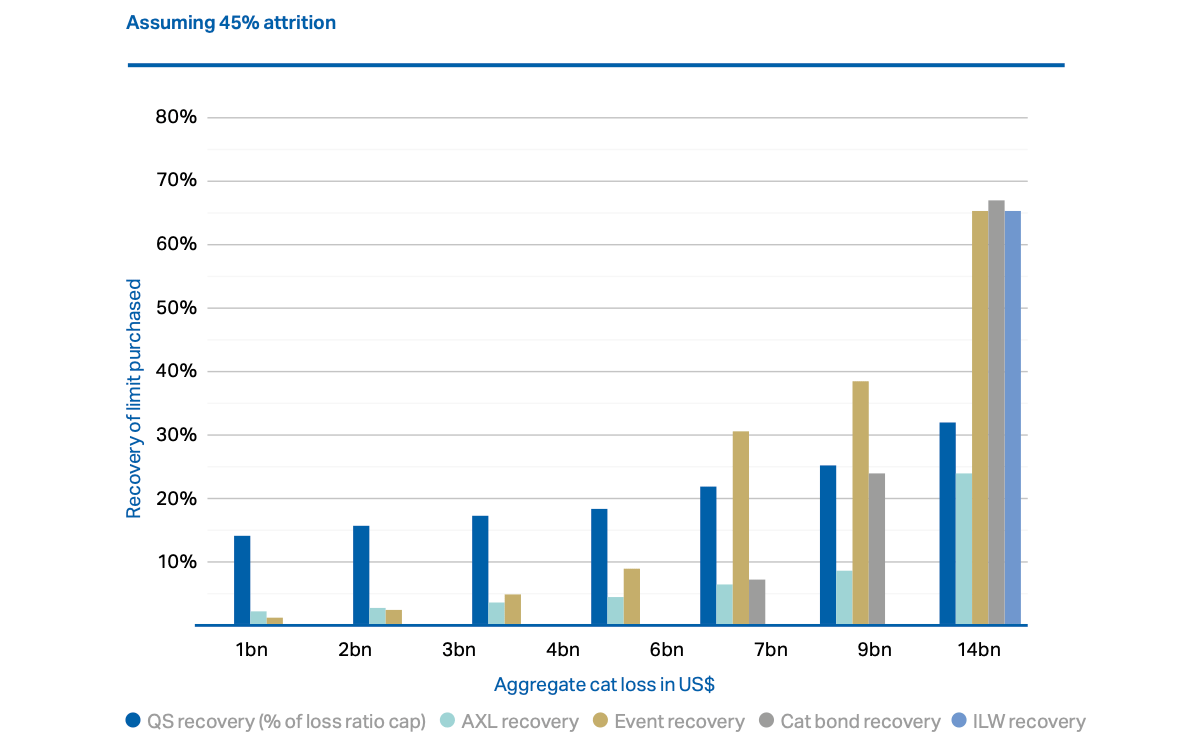

The dealer discovered that underneath sure analyses, the information means that reinsurance will not be working as effectively within the cyber ecosystem as anticipated, with even comparatively excessive cyber cat loss eventualities solely leading to cedents recovering a comparatively small quantity of their bought restrict.

Throughout the vary of cyber reinsurance instruments accessible, the disaster bond and industry-loss guarantee (ILW) are two backed by the capital markets.

The info additionally handily reveals the place the disaster bond market ought to start to fret, ought to a serious cyber loss occasion happen.

Assuming a comparatively secure attritional loss setting, Howden Re’s evaluation reveals that disaster bond losses wouldn’t start till a $7 billion or higher cyber cat loss occasion hit the insurance coverage {industry}, when lower than 10% of cyber cat bond restrict could be recovered.

Issues step up at a $9 billion cyber {industry} loss occasion, when round 23% of cyber cat bond restrict is perhaps recovered by cedents, whereas a $14 billion occasion might see round 67% of cyber cat bond restrict being recovered by deal sponsors.

Apparently, Howden Re highlights that some reinsurance instruments within the cyber safety package might not work as anticipated ought to a serious cyber disaster loss occasion happen.

“By way of this lens alone, reinsurance will not be working as effectively within the cyber ecosystem as anticipated. Determine 8 illustrates that insurers recuperate solely a small proportion of their bought restrict, even in excessive loss eventualities the place full, or close to full, recoveries could be anticipated. For instance, at a US$ 9 billion greenback cat loss, insurers solely recuperate ca. 10% of their combination excess-of-loss (AXL) cowl in a secure attrition setting,” the reinsurance dealer defined.

As you possibly can see within the picture above although, disaster bonds do look like working as designed, in not triggering till a bigger loss happens, however then delivering extra restrict advantages again to cedents for a $9 billion loss than agg XL protection and for a $14 billion loss delivering the best proportion of reinsurance restrict profit again of any safety device.

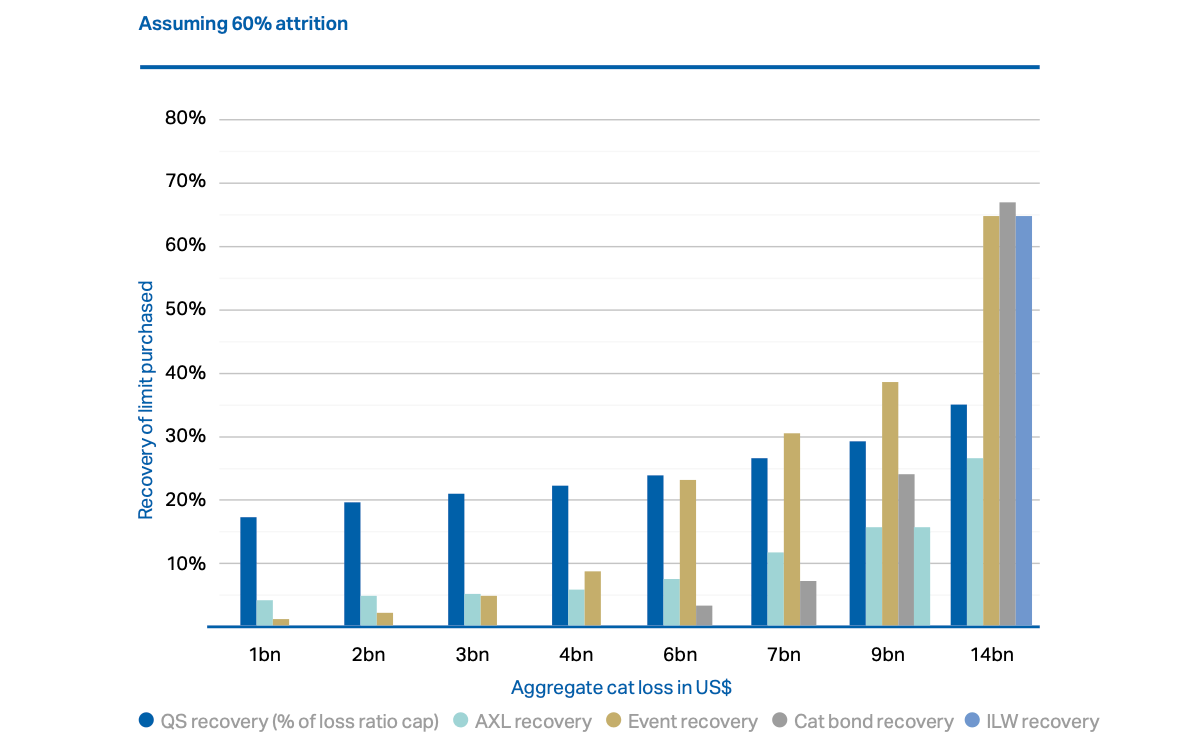

Beneath a extra extreme attrition 12 months situation, seen beneath, Howden Re’s evaluation reveals that cyber cat bond protection might start to pay-out barely earlier, with a small quantity of recoveries after a $6 billion cyber {industry} loss.

However by means of the upper loss occasions the identical type of p.c of restrict payouts would come due, with cat bonds once more providing an even bigger proportion reinsurance restoration for the most important cyber disaster occasions it appears.

It’s essential to notice that the evaluation is only one means of trying on the information, nevertheless it does counsel that for big cyber disaster loss occasions the cat bond construction can present priceless safety, that will pay-out successfully for cedents in restrict proportion phrases.

Maybe notably, the cyber industry-loss guarantee (ILW) pays out solely on the highest-level of disaster loss underneath Howden Re’s evaluation, suggesting the devices available in the market to this point have comparatively excessive loss triggers set.

Howden Re’s evaluation signifies cyber disaster bonds would work as sponsors ought to count on, triggering underneath the extra extreme disaster loss eventualities after which offering significant reinsurance restoration advantages as the scale of an {industry} loss occasion rises.

You possibly can obtain a replica of the complete report from Howden Re here.

Additionally learn: Cyber retro must be structured to attract capital markets at scale: Howden Re.